IR35

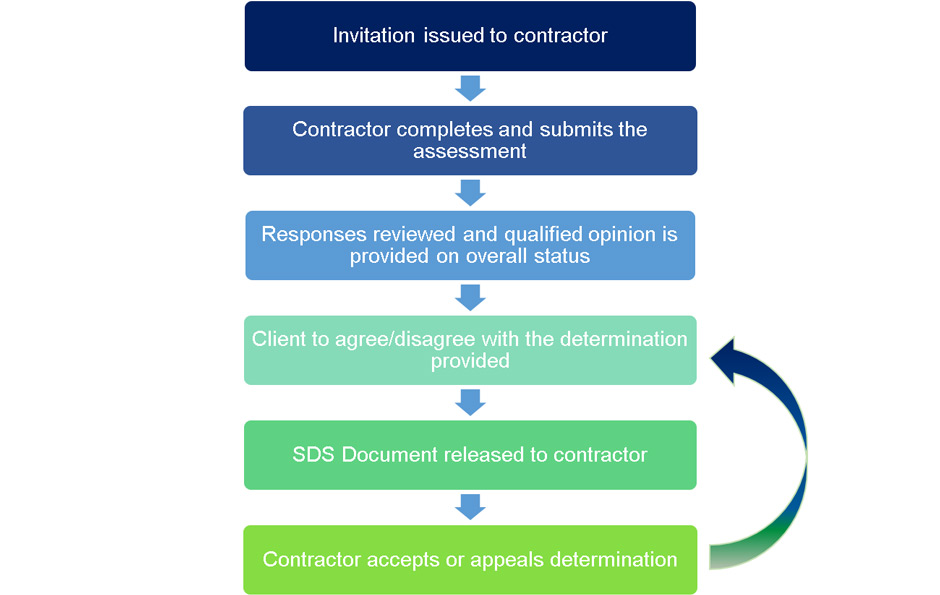

The IR35 tax avoidance reforms were first introduced in the public sector back in April 2017 and ushered in a sizeable shift in responsibility within the extended end-client-to. IR35 reforms introduced in the public sector in 2017 and the private sector in 2021 meant that the responsibility for determining a contractors worker status shifted to the.

Changes To Off Payroll Working Ir35 Rsm Uk

Full-time temporary and part-time jobs.

. IR35 is another name for the off-payroll working rules. September 23 2022 134 pm. IR35 also known as the Off-Payroll Working Rules may apply when the freelancer operates under a personal services or similar company.

How to use the IR35 calculator. Speaking to the House of Commons today September 23 Chancellor Kwasi. IR35 is tax legislation intended to stop disguised employment.

The calculator assumes you work 5 days per week 44 weeks per year. The off-payroll working rules apply on a contract-by. IR35 is a piece of tax legislation designed to stop companies from employing contractors as disguised employees.

While IR35 had previously been present within the. Dave Chaplin CEO of IR35 compliance solution IR35 Shield explores and explains what these changes could be and. A contract for the purpose of the off-payroll working rules is a written verbal or implied agreement between parties.

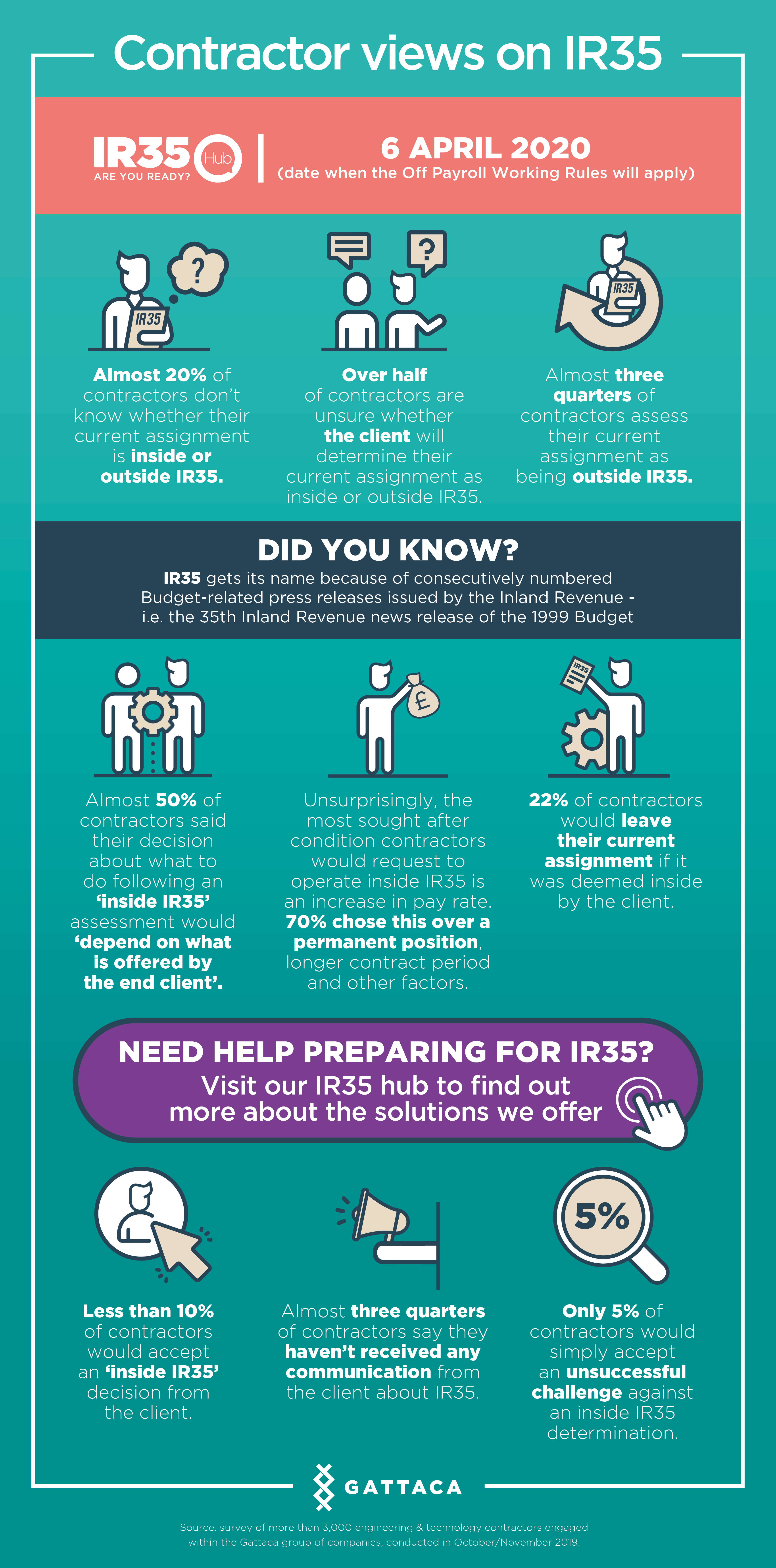

Self-employed IR35 rules are designed to work out whether a contractor is someone who is genuinely self-employed rather than a disguised employee for the purposes. In general IR35 shifts the responsibility of worker. IR35 is the abbreviated name for the anti-tax avoidance legislation that was introduced in April 2000.

Search and apply for the latest Senior project manager water jobs in England AR. The definition of small business for IR35 exemptions is likely to be based on the definition in the Companies Act which is met if a company meets any two of the three triggers below. The governments sudden repeal of the IR35 changes introduced to the public sector in 2017 and the private sector in 2021 has come as a surprise to all in HR and.

Fill in the yellow boxes to calculate your net income inside and outside IR35. The term IR35 refers to the press release that originally announced the legislation in 1999. Chancellor Kwasi Kwarteng has pledged to simplify so-called IR35 rules which affect self-employed individuals operating through a.

The IR stands for Inland Revenue and. Full-time temporary and part-time jobs. The IR35 reform will be repealed from April 6 2023 according to this mornings mini-Budget.

Search and apply for the latest Lead javascript developer jobs in England AR. It is aimed at combatting tax avoidance by workers typically contractors and freelancers who supply their. What does IR stand for in IR35.

Changes to IR35 were outlined in the recent mini-budget.

It S Time To Stress Test Ir35 Solutions Onrec

Ir35 Changes 2021 How Does It Impact Uk Life Science Businesses Proclinical Blogs

Overcoming Ir35 Changes With Global Development Teams

The Ir35 Reform 7 Key Challenges And How To Overcome Them Hr Strategy Hr Grapevine Insight

Eliminating The Outside Ir35 Risk In 2 Simple Steps

What Does The Repeal Of Ir35 Mean For Businesses And Contractors Mgi Midgley Snelling Llp

Ir35 Resolve Worsley Manchester Champion

Ir35 Repealed What You Need To Know Blog Explore Group Usa

Five Questions On Ir35 You Should Know The Answers To Michael Page